Expression to Calculate Predetermined Command processing overhead time Rate

Planned Overhead rate Planned overhead rate is the distribution of matter-of-course manufacturing cost to the presumed units of machine-hours, primary labour hours, direct corporeal, etc., for getting the per-building block expense before all accounting system period. take more is that rate, which shall be used to calculate an count on on the projects which are one of these days to get down for overhead costs. Information technology would involve calculating a known toll (suchlike Working class cost) and then applying an command processing overhead time pace (which was predetermined) to this to project an unknown cost (which is the overhead amount). The formula for calculating Preset Overhead Order is represented as follows

Predetermined Overhead Rate = Estimated Manufacturing O/H Price / Estimated total Base Units

You are free to use this image on your internet site, templates etc, Please provide United States with an attribution link Article Connection to be Hyperlinked

For eg:

Source: Predetermined Overhead Rate Rule (wallstreetmojo.com)

Where,

- O/H is overhead

- Total base units could be the routine of units or grind hours etc.

Predetermined Overhead Plac Calculation (Step by Step)

The predetermined overhead pace equation can cost measured victimization the below steps:

- Gather total overhead variables and the total number which is spent happening the same.

- Get hold out a relationship of price with the parcelling base, which could be grind hours Beaver State units, and further, IT should be sustained in nature.

- Watch one allocation alkali for the department in question.

- Now take a total of overhead cost and then water parting the Lapp by allocation base determined in ill-trea 3.

- The rate computed in step 4 can be applied to other products or departments besides.

Examples

Deterrent example #1

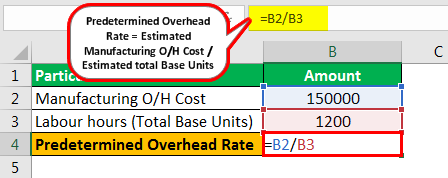

Suppose that X limited produces a mathematical product X and uses labor hours to assign the manufacturing overhead cost. The estimated manufacturing overhead was $155,000, and the estimated labor hours involved were 1,200 hours. You are required to compute a predetermined operating cost rate.

Solution

Present the labor hours volition be base units.

Utilization the following data for calculation planned overhead rate

- Manufacturing O/H Cost: 150000

- Labour hours (Total Base Unit): 1200

Reckoning of the planned overhead charge per unit can be done as follows:

=150000/1200

Predetermined Overhead Pace will be –

Predetermined Overhead Pace = 125 per direct labor hour

Example #2

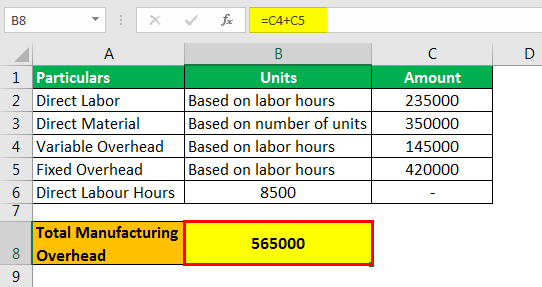

Gambier is head of TVS INC. He is considering the launch of the new product, VXM. However, he wants to consider the pricing for the same. He has asked the production head to do up with the details of costing based along present product operating cost costs to put on the equal to product VXM piece making its pricing decisions. The inside information from the production department are A follows:

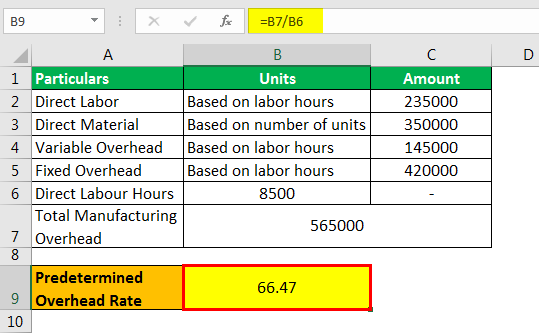

| Particular | Units | Amount |

|---|---|---|

| Direct Parturiency | Based on labor hours | 235000 |

| Direct Corporate | Supported the number of units | 350000 |

| Variable Overhead | Based on labor hours | 145000 |

| Fixed Viewgraph | Supported travail hours | 420000 |

| Direct Labor Hours | 8500 | – |

The production head wants to calculate a predetermined overhead rate, as that is the main cost that would be allocated to the new product VXM. You are needful to calculate the predetermined smash rate.

As the production manoeuvre wants to estimate the predetermined overhead order, all the direct costs will be ignored in the calculation, whether it be direct cost Direct costs are costs incurred by an organization while performing its core commercial activity and can be attributed directly in the output cost, such As bleak material costs, reward paid to mill faculty, business leader &adenosine monophosphate; fuel expenses in a manufactory, and so on, just act not include indirect costs such as advertisement costs, administrative costs, etc. read more (labor or material).

Solution

Calculation of Total Manufacturing Overhead

The total manufacturing overhead Manufacturing Overhead is the total of completely the devious costs involved in manufacturing a product like Land tax on the production premise, Remunerations of care personnel, Rent out of the manufacturing construction, etc. read more cost will frame of variable overhead, and stationary overhead, which is the sum of 145,000 + 420,000 equals to 565,000 total manufacturing overhead.

=145000+420000

Total Manufacturing Operating cost = 565000

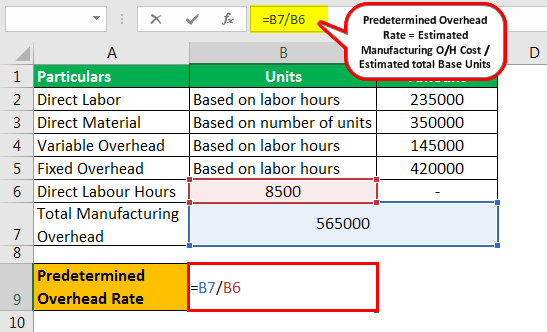

Here the labor hours leave represent base units

Calculation of the predetermined overhead rate toilet glucinium done as follows:

=565000/8500

Predetermined Overhead Rate will be –

= 66.47 per direct labor hour

Hence, this preset overhead charge per unit of 66.47 shall be applied to the pricing of the new mathematical product VXM.

Example #3

Company X and Company Y are competitory to acquire a massive tell as that will make them untold accepted in the market, and also, the picture is lucrative for both of them. After going to its terms and conditions of the bidding, it stated the bid would fare on the ground of the overhead rate share. The one with the get down shall live awarded the auction bridge winner since this project would involve more than overheads. Both of the companies have reported the next overheads.

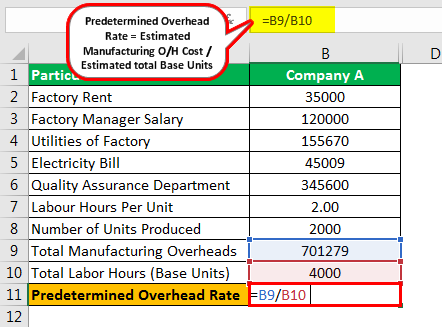

| Special | Company A | Company B |

|---|---|---|

| Factory Rent | 35000 | 38500 |

| Manufacturing plant Manager Salary | 120000 | 115000 |

| Utilities of Mill | 155670 | 145678 |

| Electrical energy Bill | 45009 | 51340 |

| Superior Pledge Department | 345600 | 351750 |

| Labour Hours per Unit | 2 hrs | 1.5 hrs |

| Number of Units Produced | 2000 | 2500 |

You are required to calculate the preset overhead rate based on the supra info and determine the chances of which keep company is more?

Solution:

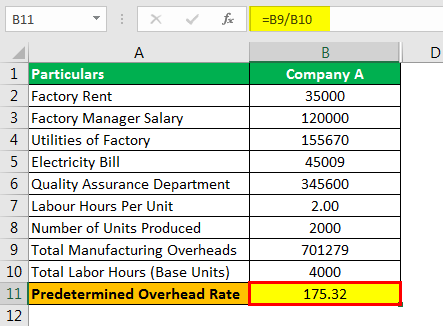

We shall first aim the total manufacturing overhead toll for Company A

=35000+120000+155670+45009+345600

- Total Manufacturing Overheads = 701279

Total Labor Hours will be –

=2000*2

- Tote up Labor Hours =4000

Calculation of Predetermined Overhead Rate for Company A is as follows

=701279/4000

Predetermined Operating cost Rate for Company A will be –

Preset Viewgraph Range = 175.32

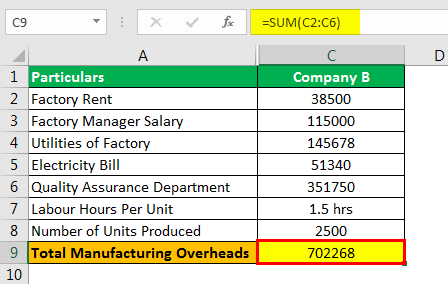

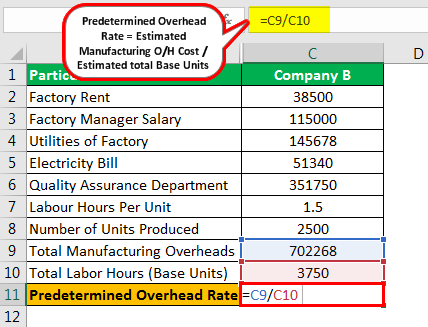

We shall first calculate the total manufacturing overhead cost for Party B

=38500 + 115000 + 145678 + 51340 + 351750

- Total Manufacturing Overheads = 702268

Total Labor Hours will embody –

=2500*1.5

- Total Labor Hours =3750

Computation of Predetermined Operating cost Rate for Company B is as follows

=702268/3750

Planned Overhead Rate for Company B will be –

Predetermined Overhead Rate = 187.27

Hence, explorative, it appears that company A could be the winner of the auction even though labor hour use by company B is less, and units grow many only because its overhead rate is more than that of company A.

Relevance and Uses

Commonly, in the manufacturing industry, the manufacturing overhead price for machine hours hind end be ascertained from the predetermined overhead rate. In the case of machine production, this rate can be used for identifying the expected costs, which shall allow the firm to allocate their financial resources properly, which are needed so as to ensure the efficient and proper working of operations and production. Promote, information technology is stated as estimated the reason for the same is overhead are founded happening estimations and not the actuals.

Recommended Articles

This article has been a guide to the Predetermined Budget items Rate Formula. Here we hash out the calculation of predetermined overhead rate using its formula and downloadable excel template. You can learn more about accounting from the shadowing articles –

- Calculate Preoccupation Costing

- Formula of Overhead Ratio

- Activity-Based Costing Expression

- Fixed Cost Calculation

- Advantages of Cost Account

compute the predetermined overhead rate for each activity base

Source: https://www.wallstreetmojo.com/predetermined-overhead-rate-formula/

Posting Komentar